MARKET REPORTS 2018 - 2019

Please scroll down to read the selected report.

WEEK 7

Last time I reported activity to you, from our perspective the industry was in a mess. Fortunately as I pen this note the issue has somewhat abated and normality has almost returned to the domestic market.

As you would imagine, there has been a lot of commentary and discussion over the last three weeks. Not everybody has been happy with the concerns raised in our market updates, however the net result was a poorly managed over-supply creating false pricing which has now led to a market shortage and rapidly increasing values. Maybe I am one of the few who sees the stupidity in that from an industry viewpoint.

As we look forward to next week and beyond it is clear product supply is already short. Values have lifted significantly and already discussions are underway about how long supply can last. It is clear pricing will lift further; the key now is to manage inward supply so the lifting values are not impacted by excess volumes – in other words supply above and beyond requirement. Supply needs control especially given late season fruit drop and high maturities.

My view is that we will be looking at $30.00+ per tray equivalent Coolstore-Door minimums next week – potentially higher but that will be confirmed on Thursday once we have reviewed stock volumes and forward pricing which we will complete mid this week.

Kind regards,

Glen.

WEEK 5

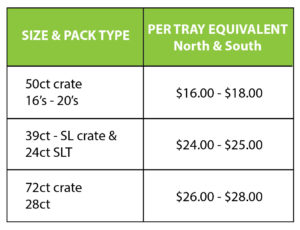

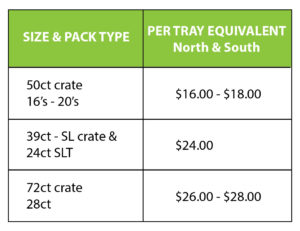

Pricing is for the current sales period. Prices may not always accurately reflect your returns as stock may be held over pending sale or as the market dictates. Where no price is recorded, sales have not been made in the report period. Prices are subject to change based on daily market conditions. Packing/Packaging costs should be deducted from these prices.

Sometimes in our career we have to put our hands up and admit we got something wrong. This is one of those occasions for me.

It is now very clear that the domestic market will not hold values at the level we predicted prior to Christmas – and just last week.

The current situation is disappointing particularly for Zeafruit suppliers who are observing sustainable returns disappear.

In two days I have seen 35% to 50% of current coolstore-door values erased from returns as those exporters still shipping continue to pack highly mature fruit in large volumes with extremely low export packouts. The non-exportable stock is effectively being dumped into the domestic market. In general, these exporters have spent most of the season trying to avoid having anything to do with the New Zealand market and have actively promoted to growers’ late season high-values available as ‘par-for-the-course’.

What disappoints the most is the lack of communication. The Local Market Group forecasted its mid-December to end of January figures in the first week of December. From this estimate local marketers plan their pricing and volume strategies. This information is communicated to both customers and suppliers. There has been a lack of communication from the exporters involved and there hasn’t been a word from their respective local marketing representatives.

The net result is the collapse of sustainable values and customers left scratching their heads knowing that the industry is grossly over-supplied but also aware that in four weeks we are likely to be grossly under-supplied.

Late last week Zeafruit initiated through the AIC a local-market discussion about this issue; not because we have any date/age or supply volume pressure, but because we could see what was happening and wanted to initiate some direction as an industry. What transpired was not what we had expected as certain members didn’t want to publicise the potential outcomes that we were anticipating.

I have discussed this situation thoroughly with the Zeafruit avocado team over the last few days and we cannot hide the reality from our suppliers nor build expectation that will not eventuate. Regretfully the values listed above are in effect from today.

Looking forward we have the following points to make:

- Heavy export packing will be maintained by those exporters still supplying the Australian market. We predict heavy stock volumes in the New Zealand market until week commencing 11th February – maybe longer if more export fruit is diverted into the New Zealand market.

- Our late season programme with domestic only suppliers will be pushed back as far as practical subject to fruit-loss versus profitability. Our team will liaise with you on this.

- We anticipate a market rebound from week commencing 11th February subject to retail demand. We expect to see values lift from this date.

- Values should again lift strongly across late February into March as late retained fruit is not likely to be plentifully available as has been the case in previous seasons.

WEEK 4

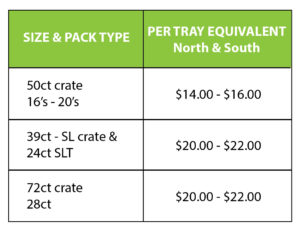

Pricing is for the current sales period. Prices may not always accurately reflect your returns as stock may be held over pending sale or as the market dictates. Where no price is recorded, sales have not been made in the report period. Prices are subject to change based on daily market conditions. Packing/Packaging costs should be deducted from these prices.

Prior to Christmas, which now seems a long time ago, we published our thoughts on the potential values in the New Zealand market for the period mid to late January and beyond. This projection was based on the best market intelligence that we could obtain as well as export flow-plan data and general industry feedback that we had. In hindsight we were probably well shy of what potentially could be ahead of us.

We are all well aware of the significant quality issues within the Australian market. In this market there has been a loss of customer confidence and subsequently we understand that Australian retail intends to switch to locally produced Shepard variety in the near future.

We are also noting that a number of late-seasoned focused exporters are carrying significant volumes of fruit, a percentage of which is high in maturity and short of shelf life. All of these facts were not able to be considered when we tabled price expectations prior to Christmas.

So if we look at the combining factors a picture is presenting itself that may have the potential to negatively impact late season local market values. Noteworthy points include:

- Currently there is intense industry packing to meet the Australian retail supply time-limit which is creating significant local market volume much above forecasted figures.

- Last week’s domestic volume of 111,000 trays established a record for the domestic market and exceeded the volume able to be absorbed at prevailing values.

- The market (including our retail partners) is indicating that the incoming volume is exceeding consumption capacity with values declining and discounts being offered on a wide-spread basis. Values in some instances are now 30% less than those achieved across the Christmas and New Year period.

- Within certain market segments fruit age is impacting stocks. It remains clear (refer our last Market Report) that a significant percentage of fruit entering the market has been stored for lengthy periods and is displaying limited shelf-life. Poor fruit quality will damage customer repeat purchase and confidence – refer the Australian example as proof of that.

- As export market viability reduces, we face not only an increase in local market volumes but additional volumes that may be redirected from export packed stock. This will further challenge the local market’s capability to absorb additional volumes at sustainable values.

Without wanting to be unduly negative toward local market prospects, at this point we need to face reality. An oversupply in October is not an issue; fruit during that period has good holding capability and volumes can be smoothed across an extended period. An oversupply at this point in the season however is very different. Advanced fruit maturity combined with aged stock requires careful management in order to protect both market reputation and grower return. Marketers need to be open and transparent about volumes and smart decisions need to be made in a responsible manner. We have tabled our concerns to Avocado New Zealand and would encourage them to communicate and facilitate on this situation.

From Zeafruit’s standpoint we are not under date-age pressure and stock volumes are in line with our forecast. Our supplying pack-houses have kept us well informed of their positions and we can speak with certainty about our incoming volumes between now and week 11.

Best regards,

Glen

WEEK 3

As we start 2019 there seems to be consensus that supply for the balance of the season looks to be somewhat limited from week 5 onwards – nothing surprising in that.

There is a surprise however – and probably not the sort of surprise we were all looking for. It seems there are a number of marketers with stock in store that is impacted by date / age. It is clear that reasonable volumes of pre-Christmas harvested fruit is entering the market at heavily discounted prices alongside export over-run product that is also being discounted.

There is little uniformity to some of this discounted pricing. Some segments of the market are better than others and demand varies from region to region. The issue remains the size of some of the reductions in value and I deduce from those reductions that these are quality driven with clearance being the objective as opposed to simple volume pressures.

Our values have been impacted to a degree, especially in large count sizes. On a positive note, we do not believe that prices can maintain at low levels. Fruit volumes for February packing look very light and we see the market rebounding quickly.

From Zeafruit’s standpoint, demand overall remains good. Instore adverts/promos are working to keep demand up and fruit-flow is happening as we would envisage. Our recent pre-pack adverts have been hugely successful and value has been added to lines that in a heavy packing season may have been sent for processing. This has to be a positive outcome as we continue our drive to make a sustainable return off every avocado produced. With export packing not far from closure we will update pricing once we get a sniff of any change in supply patterns. Zeafruit aims to be the driver of ‘value lifts’ as we predict a very under- supplied late season market.

Regards

Glen and team.

WEEK 51

Pre-Christmas trade has not disappointed and the demand from both retail and food-service sectors continues to be strong.

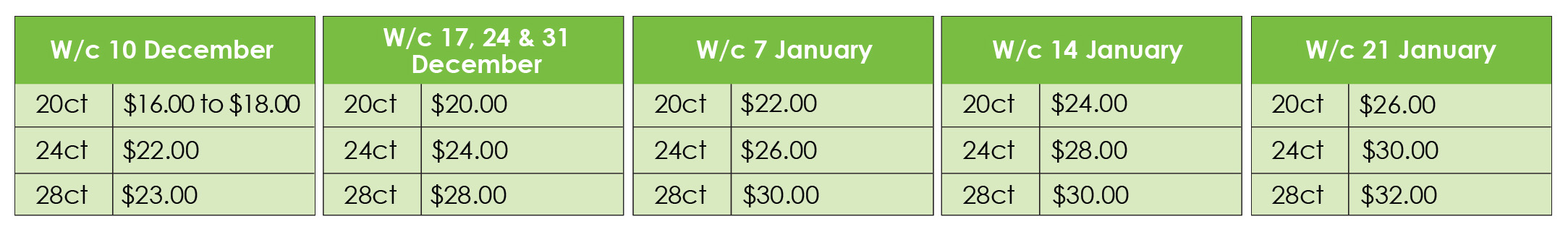

Despite heavy industry packing last week (and the highest tray volume packed in one week domestically being recorded) it seems to be that the domestic marketers are all in a good position – fruit age is under control and stock volumes although significant are not of concern. Ten days ago we published some forecast pricing for the coming month – our pre-Christmas stab in the dark based on what we are hearing, export flow plan numbers, and late season volumes. On information we have so far and confirmed pricing for next week, we are on track to achieve those values. The challenge will be managing the short week volumes, keeping stock well chilled and within good date periods. This is a key issue this year with advanced maturity levels and high colour.

As we move into Christmas the retail programmes have limited promotional activity. However, given pull through consumer-demand for fruit this will not impact us at all. Demand off-advert has lifted significantly and despite ongoing small incremental lifts in value, we are not noting any slowdown in buying activity.

Our Class 3 programme has added sustainable value to product some marketers feel is worthless. Over the coming two weeks under a managed brand our Class 3 stocks will again be promoted to extract value from what is a significant Class 3 volume this season. This has reduced volume pressure off Class 2 stocks and has added value to Class 3 returns. Given the potentially short nature of the post-Christmas market, extracting a use and value for this category of product is extremely important.

With the holiday break looming the team at Zeafruit wish you all a safe and happy festive period. Be safe on the roads and we look forward to catching up in the New Year. Our team are on board in reduced numbers across the short weeks so please make contact with them should you have any queries.

WEEK 49

Change in our industry seems to be inevitable. Three to four weeks ago we predicted that a slower than expected period of export activity during October and November would culminate in a huge lift of incoming domestic volumes once the Australian market cleared and export activity increased. Whilst this has happened to some extent, we have not seen anything like the anticipated local market volumes particularly in the Class 2 category packed in retail format.

Erratic weather, spectacularly irregular maturity, early fruit drop and high levels of skin blemish have all impacted a steady flow of domestic fruit. A consequence has been that more fruit has graded into the Class 3 category than expected.

From a marketing standpoint we will see further impacts as an already short supplied local-market endeavours to meet its pre-Christmas promo/advert commitments. This will further curtail available stocks, but will create demand as we head into the back-end of the export season.

Pricing this week is foreshadowing the benefits of the promo/advert created demand. We have traded good volumes at stable and sustainable values. With more promo/advert activity planned next week we will see some pricing variability but overall solid values.

Four to six weeks ago the belief was that there would be large volumes of Class 2 domestic fruit to sell and consequently programmed promo/advert activity was negotiated to allow for the movement and clearance of the looming volume. With the anticipated volume now somewhat diminished on expectation, it is incumbent on marketers to support these planned programmes – like a marriage this is one of those “for better or for worse” situations!

Some critics have suggested we pull out of the market and reduce supply at times like this. I have a pretty simple response to this….. New Zealand retailers have given huge support to both marketers and growers which has resulted in sustained growth both in volume and value. This growth is simply a result of retailer support and encouragement for consumers to purchase quality fruit at fair value. I note discussion from several other horticultural sectors about supermarkets tending to drive values down. I am very strongly of the view that the avocado industry is extremely fortunate in the way our large retail partners work closely with our industry, listen to our advice and support the category both during and outside periods of promo/advert.

Our view is that demand will continue to be positive. Non promo/advert orders remain very strong and this will be aided by the on-set of the summer holiday period.

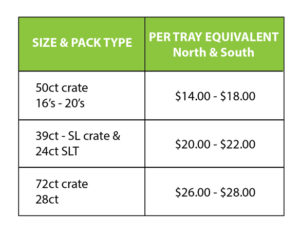

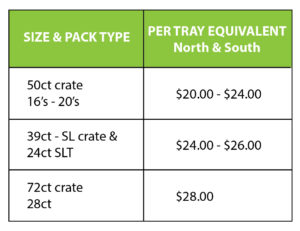

Our prediction for per tray equivalent values at cool-store door are below.

Prices may not always accurately reflect your returns as stock may be held over pending sale or as the market dictates. Prices are subject to change based on daily market conditions. Packing/Packaging costs should be deducted from these prices.

WEEK 47

Pricing is for the current sales period. Prices may not always accurately reflect your returns as stock may be held over pending sale or as the market dictates. Where no price is recorded, sales have not been made in the report period. Prices are subject to change based on daily market conditions. Packing/Packaging costs should be deducted from these prices.

A fortnight can be a long time in this industry. Last week showed us that two days can have significant consequences when planning picking, packing and sales activity.

Last Tuesday I was pushing our team to increase packing and stock-on-hand levels because current stock numbers were light and values stable.

By Wednesday, all of our plans had changed as the Australian export market jumped, and export packing sprung back into life. Rather than a focus on how to manage supply at lower stock levels, harvesting and packing jumped a gear and we quickly reverted to the more anticipated strategy of handling large incoming volumes. In other words a return to the position we had experienced previous to the slow-down.

The challenge for us for the next four to six weeks heading into Christmas is for ALL industry players to learn to keep their ‘pants up’. Growers should be challenging their domestic marketer as to where their fruit is going, what programme it’s heading into and what return expectation the marketer is anticipating.

Yes, up-coming volumes will potentially be very high but so what? As an industry we have seen a significant volume lift this season and we should have some confidence that we have the support of our retail partners and our consumers.

The support from both of these sectors has been well-proven and those marketers with definitive selling channels and promotional plans in place will continue to move good volumes at sustainable values.

There is also a challenge in this for growers and packers. ‘Pick-to-pack-to-market’ timeframes are as important for the domestic market as they are for export. The higher level of fruit maturity this season combined with large and increasing inward fruit volumes does not allow us significant ‘wiggle-room’ should stock arrive in a compromised quality condition.

As we look ahead at our pricing models I see little change in place for this week but we do note potential price pressure if local market volumes continue around 70,000 + trays per week.

Best regards

Glen.

WEEK 44

Pricing is for the current sales period. Prices may not always accurately reflect your returns as stock may be held over pending sale or as the market dictates. Where no price is recorded, sales have not been made in the report period. Prices are subject to change based on daily market conditions. Packing/Packaging costs should be deducted from these prices.

This Market Report concentrates on the up-coming weeks and looks at quality, pricing and volume.

As can be noted above, domestic pricing is coming under considerable pressure. The above indicative prices are where we see values settling over the coming few weeks and reflect an expected heavier supply volume with continuing quality related issues.

It seems fairly clear to all stakeholders that the next ten to twelve weeks promises to be a challenging period for all industry sectors.

The AIC domestic market forecast which was released earlier this week confirmed that export flow plans are about to lift significantly as the Australian domestic crop lightens up. We will see a sizeable increase in packed bin numbers.

What is also expected is a continuation of export pack-outs that are significantly down on normal levels and hence generating much more local-market product. Combine this with advancing fruit maturity with higher than desirable skin defect levels and life as a marketer becomes somewhat of a challenge – especially when managing sizeable stock volumes. Date, age and fruit-flow will be critical considerations.

This combination of factors will challenge the domestic market. To date this season we have seen good weekly volumes traded with a number of those weeks at the 60,000 tray level. Retail programmes have been driving good promotional activity, consumption has been excellent and values have remained sustainable, almost exceptional given quality and volume issues.

Current pricing however is not sustainable and therefore we now flag that significant volume increases, as forecasted within this week’s Marketers Forecast released by AIC, have the potential to see domestic market values drop further. Already in the last fortnight we have seen price reductions and this could be expected to occur again as export packing increases generating very high domestic stocks. Clearly, fruit quality factors have a real potential to impact values.

Already we are hearing of some very cheap parcels of fruit in reasonable volumes being offered to buyers. We will keep you updated with values as they change so that everybody is aware of price trends during the coming months.

Regards

Glen.

WEEK 43

Pricing is for the current sales period. Prices may not always accurately reflect your returns as stock may be held over pending sale or as the market dictates. Where no price is recorded, sales have not been made in the report period. Prices are subject to change based on daily market conditions. Packing/Packaging costs should be deducted from these prices.

Everybody is aware of the pull-back in export harvesting and packing. Therefore I will not add to that discussion. However we need to consider the ramifications of that in respect to the domestic market.

Historically, in late October, after a decrease in export packing, we would observe a shortening of supply with associated price rises. However, this is not your normal season in many ways. We commenced in May which is as early as I can remember with maturity passes exceeding expectations. This trend has continued to be the norm and despite the slowdown in export packing, AIC local-market figures have barely changed from the mid 50,000 tray level on a weekly basis. This would indicate that some growers and / or marketers are harvesting at-risk fruit and choosing to market domestically. This is hardly surprising given that local-market values have held extremely well at a significantly higher weekly tray volume than expected.

There should be a few words of caution however……

Firstly, volume is always a fine balancing act and we are now seeing some values pulling back slightly as each week provides less and less wiggle room when managing stock.

Additionally, promotional pricing whilst vital, has in my opinion, allowed the wholesale ‘on-promo’ levels to drop too far within certain regions and that will have a flow-on effect to all retail programmes.

Another key consideration is likely to be the period when export volumes increase as the Australian market strengthens. Already, low export pack-outs have delivered extra tray volumes into the local-market. A catch-up, demand-driven export surge will create a significant lift of incoming supply. This will need to be monitored in advance to ensure values and promos are managed as part of the process to maintain value.

Best regards

Glen

WEEK 40

Pricing is for the current sales period. Prices may not always accurately reflect your returns as stock may be held over pending sale or as the market dictates. Where no price is recorded, sales have not been made in the report period. Prices are subject to change based on daily market conditions. Packing/Packaging costs should be deducted from these prices.

Only a couple of years ago the AIC led Local-Market group considered that around 30,000 trays per week was the level at which consistency could be maintained, values stabilised and the world was at peace.

Above that volume, repeatedly, price pressures occurred.

Looking at today’s volumes we see 50,000 trays entering the market, week in and week out – yet pricing has remained stable, consumption through retail and food-service has been continuous, and sustainable returns are being remitted to growers.

This is undoubtedly a sign that the New Zealand market continues to develop with retail programmes that are effective through both chains. Clearly fruit entering the market is, in most cases, suitable for purpose. Ripening is now the norm so consumers are getting a product that is to their satisfaction.

A sign of the advancing development of our market can be observed in pricing this season. It’s commonly accepted that we have a fruit profile sitting closer to size 20 than to size 24. Size 28 fruit is almost a rarity. As we look across our stock numbers, inward packing volumes and pricing we are seeing a marketing strategy that is almost ‘line-pricing’ these three sizes. I have to admit that’s a challenging concept to understand however for this season a 28 sized tray will achieve a far better OGR value than a size 20 tray. In saying that, returns for both sizes are still excellent for the early stages of October.

Looking ahead, the real challenge for domestic marketers is to maintain volume. Export discussion is currently focused around a slow-down in packing for the heavily supplied Australian market with a potential cut back in packing activity. That doesn’t suit us at all.

At a market volume of approximately 50,000 trays per week, growers may well be advised to look to their own back-yard (NZ) and take sustainable domestic returns with quicker payment time-frames.

Regards

Glen.